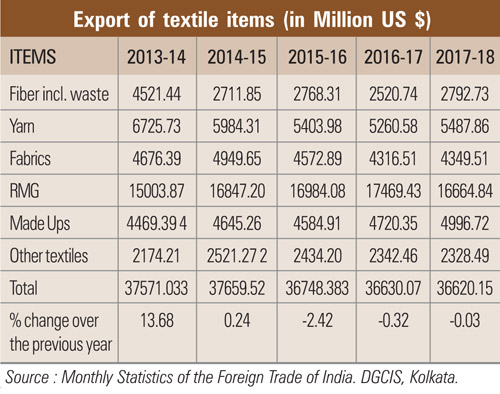

India is the world’s second-largest exporter of textiles and apparels, with a massive raw material and manufacturing base. The textile industry is a significant contributor to the economy, both in terms of its domestic share and exports. It contributes about seven per cent to industry output, two per cent to the GDP and 15 per cent to the country’s total exports earnings. The sector is one of the largest sources of job creation in the country, employing about 45 mn people directly.

The Indian textile and apparel market was worth $ 90 bn in 2017. The market is further projected to reach $198 bn by 2023, at a CAGR of around 14 per cent during 2018-2023. India is the second largest textile exporter in the world. India’s share in global trade of textiles and apparels is approximately 6 per cent. Today, the textile and apparel market has become a vital contributor to the Indian economy. The apparel export has seen a positive trend from November 2018 onwards.

Between April-December 2018, Ready-made garments (RMG) exports from India stood at $11,350.44 mn. India is the largest cotton producer in the world (35.1 mn bales of 170 kg each). The data on ‘Quick estimates of textiles & clothing for the month of December 2018’ recently released by DGCIS has shown that export of cotton textiles (yarn, fabrics, made-ups) under the purview of council have increased to $8,394 mn during April-December 2018 from a level of $7,531 mn during April-December 2017 recording a growth of 11 per cent.

If taken together, total textile and apparel exports from India increased by seven per cent to `1600.10 bn in April to November 2018, compared to exports of Rs. 1492.54 bn in the corresponding period of last fiscal. In dollar terms, however, exports remained flat at $23.18 bn during the same period. India’s textile and garment exports growth moderated in November 2018, after a sharp 38 per cent jump in October, due to a sharp volatility in the rupee-dollar exchange rate. The total exports of textiles and apparel are expected to touch $82 bn by 2021 with CAGR of 12.06 per cent.

Recent Government Initiatives

To promote exports of readymade garments and made-ups, Government of India increased Merchandise Export from India Scheme (MEIS) rates from 4 to 6 per cent under the Mid- Term Review of Foreign Policy 2015-20. The government is also making investments under the Scheme for Integrated Textile Parks and the Technology Upgradation Fund Scheme for training workforce and to encourage private investment in the Indian textile and apparel industry.

In order to follow the goal of making India’s development inclusive, the Central Government is focusing on a number of policies in providing best manufacturing and infrastructure to local artisans, technology and innovation, enhancing skills and strengths of the local industry. The government has been implementing various policy initiatives and programmes for development of textiles and handicrafts, particularly for technology, infrastructure creation, skill development, including:

- Amended Technology Upgradation Funds Scheme (ATUFS)

- PowerTex India Scheme

- Scheme for Integrated Textile Parks

- SAMARTH- scheme for capacity building in Textile Sector

- Silk Samagra- integrated silk development scheme

- North Eastern Region Textile Promotion Scheme (NERTPS)

- National Handicraft Development Programme (NHDP)

- Comprehensive Handicrafts Cluster Development Scheme (CHCDS).

The Textile Ministry of India announced Rs. 690 cr ($106.58 mn) for setting up 21 ready-made garment manufacturing units in seven States for development and modernisation of Indian textile sector.

The Government also launched a special package to boost investment, employment, and exports in the garments and made-up sector. The special package was designed to create upto one cr jobs, and boost exports by $31 bn and attract investment of Rs. 80,000 cr in 3 years. So far, it has generated additional exports of Rs. 5,728 cr and additional investments of Rs. 25,345 cr.

Government is now bearing 3.67 per cent of Employee Provident Fund (EPF) contribution for new workmen in addition to existing reimbursement of 8.33 per cent employer contribution under Pradhan Mantri Rojgar Protsahan Yojana for three years.

Market drivers

India represents the largest producer of jute and cotton, and the second largest producer of silk. Due to the high abundance of raw materials coupled by cheap labour costs, the cost of manufacturing textile and apparel is significantly lower than many other competing countries.

India currently has one of the world’s largest young population. Currently around half of the total population is below 25 years of age. This age group represents one of the biggest consumer group of textiles and apparel and is expected to drive the spending over the next five years.

Catalyzed by increasing penetration of the internet, online retailing has witnessed strong growth in the country. Consumers are now looking for ease of shopping, multiple options, better offers and easy return policies. The growth in online sales has enabled the textile industry to reach consumers residing across every corner of the nation.

Catalyzed by increasing penetration of the internet, online retailing has witnessed strong growth in the country. Consumers are now looking for ease of shopping, multiple options, better offers and easy return policies. The growth in online sales has enabled the textile industry to reach consumers residing across every corner of the nation.

Due to a change in buying habits, consumers are now shifting from need-based clothing to aspiration-based clothing. Contrary to previous years, where the Indian consumers purchased fashion items as and when required, buying clothes has become more than a basic need; it is now a reflection of aspiration, personality, and a status symbol. Though basic textiles continue to represent a part of the consumer’s basket, the demand for aspirational clothing has increased significantly in recent years. Given the timely policy support and intervention to boost exports, the industry is hoping to achieve the target of $12.65 bn set for exports of cotton textiles during FY 2018-19.

With all this positive steps and recent trends, the future of Indian textile and clothing industry looks very positive.

In the next few pages we are covering

comments of some of the leading industry

players about 2018-19 industry scenario.

Industry Comments…

Dr. KV Srinivasan Chairman, TEXPROCIL

With products such as yarn, fabrics and home textiles of cotton and blends under its purview, TEXPROCIL handles an export base of $12.6 bn (Approximately `90,000 cr) in cotton textiles constituting around 63 per cent of total textile exports of $20 bn (approximately `140,000 cr).

The data on ‘Quick estimates of textiles & clothing for the month of December 2018’ recently released by DGCIS has shown that export of cotton textiles (yarn, fabrics, made-ups) under the purview of council have increased to $8,394 mn during April-December 2018 from a level of $7,531 mn during April- December 2017 recording a growth of 11 per cent.

The positive trend in exports has been the result of council’s continuous interaction with the government and pragmatic approach shown by the Ministry of Finance, Ministry of Commerce & Industry and Ministry of Textiles, on the issues of T&C Industry. Given the timely policy support and intervention to boost exports, the industry is hoping to achieve the target of $12.65 bn set for exports of cotton textiles during FY 2018-19.

To be more competitive globally, the industry needs to take various steps. Interactions with a cross section of small / medium / large / producers / exporters / distributors of textile and clothing items suggests that there are a few areas, which would require government intervention / strategisation by the industry so that the present market size of textile and clothing estimated at $139 bn can be increased to $220 bn by 2025. The following five areas need to be addressed for making the Indian textile and clothing industry more competitive globally: Preferential access given to competitors by the European Union, Refund of embedded taxes, Increasing cost of compliances, Scaling up design content in the Indian fabrics & home textile products, Need to encourage / incentivize digital printing for value added made-ups.

Based on the current scenario, TEXPROCIL is confident that in the coming months, with government support, the industry would be in a much more comfortable position. While many of the concerns have been addressed, there still remain a few issues which the Council has been taking up at various fora. To highlight a few, these are, extension of ROSL Scheme to yarn and fabrics, extension of MEIS to cotton yarn and inclusion of cotton yarn in the interest equalisation scheme. One of the critical issues will be the formulation of WTO compatible alternative schemes to replace the present ones like the MEIS, EPCG, EOU’s/ EPZ schemes.

TEXPROCIL has already submitted a set of proposals to the government on the WTO compatible schemes and hopes that it will be examined expeditiously and implemented on an urgent basis. While we await the formulation of alternative schemes, we are nevertheless pursuing proposals under the existing schemes (as part of our unfinished agenda) with a view to gain a level playing field with our competitors who benefit from preferential access and hidden subsidies.

It is in this context, the council has proposed the inclusion of cotton yarn under the existing MEIS. Even though the MEIS is likely to be phased out in a short while, we feel that cotton yarn as a value added product deserves to be included even during this short period, as a lot of value addition is taking place within the country. Further it is the only product that has been deprived of export incentives as the yarns made from manmade fibre get the benefit of MEIS.

Secondly, in the case of fabrics there is a need to increase the MEIS rates from 2 per cent to 4 per cent. The recent drawback rates for fabrics have also been increased marginally and there is a need to support the weaving sector with a higher level of incentives so that India can truly become a hub for fabric production in South Asia.

Thirdly, the ROSL scheme needs to be extended to the entire textile value chain i.e. including yarns & fabrics as these products also face the incidence of State levies especially like electricity duty & excise duty on diesel & petrol which are used in transportation of raw materials by road. All these un-rebated taxes have a cascading effect thereby affecting our manufacturing competitiveness. Apart from the policy support, there is an urgent need for expediting the conclusion of FTAs with countries like the EU, Australia, Canada, etc. We hope that the government will find a creative solution to the ongoing impasse on these matters. Industry is hopeful that government would take suggested measures to boost exports, thus leading to enhancement in the employment prospects and scaling up of production in T&C industry.

Sanjay K Jain Chairman, CITI

2018 was better for the industry as it slowly recovered from the demonetisation and GST impact. Apparel exports finally became positive in the 2nd half of the season and IIP also was positive for apparels. However, due to liquidity constraints, the apparels companies were constrained in their growth. 2019 is expected to be better and hopefully the government will rectify the remaining issues of GST for the industry and also increase drawback and ROSL rates for exports to compensate for the tax incidence on the industry.

Industry faces a non-level playing field in many markets due to tariff barriers, however industry needs to improve its productivity levels, economies of scale and organise itself better for large production at competitive prices.

Apart from the issues mentioned above, we hope A TUF can be streamlined by the govt. so that subsidies are received by the industry in a time bound fashion and the old pending claims are settled to ease the working capital constraints of the industry especially the MSME players.

Vijay Jindal Owner, SPL Industries Limited

The global textile industry impacts nearly every human being on the planet. The industry is currently worth nearly $3 trillion and includes the production, refinement, and sale of both synthetic and natural fibres used in thousands of industries. The textile industry encompasses a broad and diverse range of products with an even wider range of applications.

In 2018, the Indian apparel industry was affected due to the introduction of GST (Goods and Services Tax). During the phase, exporters were majorly affected as they tend to book more orders per year, whereas after GST implementation they landed booking only 70-75 per cent throughout the year. In 2019 exporters were looking at becoming more competitive to book more orders, as government has made a major contribution in the Indian economy by reducing the GST for fabric yarns from 18 per cent to 5 -12 per cent now.

To boost the growth of this industry as an exporter we would like to suggest that our industry should get more duty drawbacks from the government. Earlier, it was 7-8 per cent but now it is only 2-5 per cent. Hence it should be increased to make us more competitive globally.

Mahesh Maheshwari Director, Nimbark Fashions Limited

First half of 2018 passed in GST stabilization where all the nuances with regards to costing post GST, procedures, and compliances got fully understood and embedded into business. Second half of the year was dominated by volatile forex market, which didn’t allow exporter and importer to set in. But at the fag end of the year around October, domestic market started showing good demand which continued in even early part of 2019. At the same time, export market is also showing sign of improved demand. So year 2018 was not so great as far as growth is concerned but has set in a good platform for year 2019. We expect 2019 to be a good year for growth in textile industry.

Focused approach towards quality and value addition in product is must for creating competitive advantage. We cannot be as competitive as Bangladesh or Vietnam in terms of labour and other costs but we can certainly move up in quality of product so that customer is forced to come and procure from India.

As textile Industry is second largest employment providing industry but our industry is facing challenges to get skilled workforce. Government should put up centers along with industry to meet demand for skilled workforce where we can meet cost & delivery with international demand. Government should provide incentives to the companies who are adopting best global practices of the industry in order to improve quality of the products as well as delivery mechanism. India can only sustain in global competition if it can keep improving quality of the product and timely delivery.

Selva. T MD, Sri Kalyan Export P. Ltd. India

We feel it’s a good year for us like previous years in spite of various issues like GST, Competition from other countries, labour shortage etc., we work with various strategies to keep us updated in terms of new fibres, sustainability, technical aspects, Compliance standards etc., so we able to maintain and pushup our business each year. We are very positive in 2019 also our works will speak for us and able to achieve atleast 5 per cent growth compared to previous years. Sri Kalyan Export is proud to be certified with GOTS, Oeko-Tex, Fair Trade, BCI, SA 8000, OCS for Woven Fabrics Manufacturing and Exports in Prints, Dyed and yarn dyed and using Sustainable Fibres like Organic Cotton, Lyocell, Linen, Flax, Hemp, recycle Cotton etc., which benefits our customers and also environment majorly.

We think our textile industry should work towards quality, sustainability, technical standards, being environmental friendly instead of working towards cheap price products. Our quality and standards should speak for our products and pricing. Profitability is a must for maintaining sustainability, environmental benefits and labours welfare without that making turnovers never solve the purpose.

We are expecting our Govt. should support in a better way consulting our textile experts who are directly involved in manufacturing and exports as they know exactly what are the issues faced practically and what shall be done to solve it. Without consulting those making policies will not be so useful. And also FTA with Europe is long standing requestfrom Textile Industry which will benefit and revolutionize textile industry. And also keep track on raw material pricing mainly cotton is a must for saving small and medium textile units who affected a lot during order season, as big mills who having own spinning mills not affected by Cotton pricing who procure and keep stocks.

Atul Mittal Executive Director, Pratibha Syntex Ltd.

Year 2018 has been challenging for us as well as the industry on many fronts. Handling the impact of GST, lost revenues due to cut down in incentives, increased costs of fuel and transportation, fierce price competition from low cost countries.

To be able to have a significant position in the global apparel market, a multiprong approach will be needed for the industry. Manufacturers and exporters must create a competitive edge which many countries have already done. India is not a favourite buying destination for a huge number of apparel buyers. The reasons are multiple:India is not known as a manufacturer/supplier of various apparel categories like synthetic athletic and active wear, washed denim apparel, hand-flat knitted sweaters, technical outerwear etc. Skill and capability developments are the need of the hour, to be able to grow the global market share; Focus on quality and delivery timelines needs attention; High manufacturing lead times.

A large business has already moved towards the countries and companies that offer a shorter lead time to the customers. This not only improves the sales of brands & retailers but also reduces the hold time of finances. Reasons are simple, closer to season/market – better the chances of buying/selling the right product; Sailing times and freights are higher for many countries which gets coupled with higher manufacturing lead times. A joint dialogue between shipping lines/airlines, exporters, councils and the government may help to improve this situation; There’s a significant worker shortage in the apparel sector. Government is running several programs to train and employ new workforce. But, at the same time, it would be good to think of some level of automation in the sector, to minimize the impact.

Governments can do a lot to support and grow the apparel sector that earns a significant forex for the country: It’s necessary to better incentivize the apparel exports from India amidst growing global pressure on prices; Create a watchdog to monitor, control and strengthen operations at all ports, especially during the peak seasons. Often it becomes tough to meet the target deadlines due to congestions and spikes at the ports. Freight rates also need to be more competitive. There’s a need to push more FTAs with various countries. India is in a disadvantageous position for exports to many countries especially the EU where the neighbouring Bangladesh, Pakistan and Sri Lanka get duty-free access.

P Vivekanand MD, Armstrong Spinning Mills (P) Ltd

We are one of the leading manufacturers of 100 per cent Organic Cotton Yarn (GOTS & OE-Control Union Certified) and Fair Trade Organic Cotton Yarn (FLO CERT Certified) with a vertical set up from yarn to garments. We are expertise in producing count Ne 6’S to 60’S Combed Cone, suitable for high speed Knitting & Weaving with well-controlled contamination. Value added like Compact & Slub yarns (CAIPO) & Dyed Yarn in Organic & Non Organic.

In 2018 Indian apparel industry was stable on global market front. I think it will be much more stable in 2019. To be more completive globally, the Indian textile industry should work more on skill enhancement and automation. As far as our expectations from the govt. for further growth of this industry are concerned, I think the government at both Centre and State should make easy convenient global exporter policy.

Sandeep Rohilla President – Marketing & Sales, Bhilosa Industries Pvt. Ltd.

It was year of opportunity!! Till July / August was not good period due to many uncertainties, but 2nd half of 2018 was excellent in terms of demand. Fabrics demand was excellent, so the yarn sale was good. The coming year seems to be excellent due to good demand in domestics as well as in export segment. Rise in income level is expected to drive demand in textile industry.

To be more completive globally, industry should focus more on new product. Value addition will help to grow export segment. As far as expectations from govt. are concerned, I think already govt. is doing their level best, however to be more comparable with other counties, export schemes & other benefits to the manufacturer of yarn / fabrics has to be made. GST returns has to process fast. They should arrange more meeting/seminar at small levels with end users to understand their difficulties.

Mukesh Bansal Vice President Vardhman Textiles Limited

2018 was pretty difficult year from fabric business point of view. We had to face couple of challenges. The Indian garment export has declined by almost 15 per cent this year as compared to last year. The reason is unfavourable exchange rate resulting into lower order booking. The domestic market is taking time adjusting to GST regime. Therefore the demand has been sub dude from both the market segments. The strong raw material prices made the situation more difficult. 2019 seems to be better on both the fronts, as the exchange rate and raw material prices both seem to be settling at a reasonable level. The normal demand cycle should pick up soon.

To be more competitive globally we need to strengthen the complete value chain. The weaving by itself cannot add strength unless the overall exports from India pick up. With the shortening lead times, no buyer wants to export the fabric from one country to another. That’s why the countries like Bangladesh and Vietnam are expanding on the textiles side. For India to gain a global position in fabric, the garment export from India has to grow. We are still lacking in terms of logistics infrastructure. Still our transportation lead times are very high. The time taken for exports at exit points at Indian borders need to be shortened.