Post-pandemic, the Indian textile sector is now on a recovery path. However, the demand-price equation is suffering from an imbalance at many levels of this sector. Exorbitantly high cotton yarn prices are an area of concern for fabric and garments manufacturers. They hope that the prices will stabilise in the coming months due to increased production. Since yarn prices are yet to adjust itself in the downstream industry, textile millers and garments unit owners are “not too anxious about obtaining stocks at the moment,” Commodities Control said in its first of the three cotton special series report.

Post-pandemic, the Indian textile sector is now on a recovery path. However, the demand-price equation is suffering from an imbalance at many levels of this sector. Exorbitantly high cotton yarn prices are an area of concern for fabric and garments manufacturers. They hope that the prices will stabilise in the coming months due to increased production. Since yarn prices are yet to adjust itself in the downstream industry, textile millers and garments unit owners are “not too anxious about obtaining stocks at the moment,” Commodities Control said in its first of the three cotton special series report.

Moody’s Investors Service Company ICRA has revised the FY2022 outlook for the Indian textile sector to ‘stable’, the rating agency added that risks, however, remain given the nascence of recovery and the continuing impact of the pandemic.

“Indian as well as the global cotton output is expected to decline in CYG’21 (Global Cotton Year ending July 2021). As the demand is likely to rebound on recovery from the pandemic impact, cotton stocks are expected to decline. However, despite moderation, absolute cotton stocks as well as the cotton stock-to- use ratio are expected to remain high, owing to sizable carryover stocks brought forward from the previous year,” ICRA said in its report.

It is to be noted that the cotton textiles industry is witnessing a recovery in nearly a decade. The sector underwent particularly bad phase two years prior, i.e. even before the pandemic struck.

Meanwhile cotton yarn prices are expected to stay firm tracking the bullish trend in global cotton prices. The latest World Agriculture Supply and Demand Estimates Report by the US department of agriculture (USDA) points towards lower global cotton output and improved consumption for the 2020-21 crop year.

Cotton output is seen dropping in the US as well in India, while cotton exports are seen rising in the latter. ICE cotton prices have travelled all the way from sub-50 cents to 82 cents level in mid-January.

This reflected in domestic cotton prices along with woven cotton yarn. The prices of the latter surged from `193.81 per kg in August 2020 to `267 per kg very recently in January 2021. That’s a rise of 37.7 per cent in less than six months, while the yarn prices have gained 10.23 per cent since last month.

Demand for domestic and international yarn and textile products has increased sharply. According to Texprocil, exports of cotton yarn, fabrics, and handlooms has surged over 14 per cent to `7,260 cr.

However, on yearly basis, the exports have dropped for the three quarters of the current financial year by 4.89 per cent to `50,506 cr. It is to be noted that decline in the export number was restricted to months prior September 2020.

ICRA, in its report, observed that yarn output during corona-led lockdown had dropped by 76 per cent. However, with the improvement in domestic and exports demand, post May 2020, yarn production bounced back. Cotton yarn production during September-October 2020 witnessed a rise of 3-4 per cent year-on-year. Total output may have slipped by 35 per cent during the seven months of the current financial year, however it has picked up pace and indicates continued rise hereon.

According to Sanjay Garg, President of North Indian Textiles Mills Association (NITMA), “the players in the sector jumped into action towards obtaining raw material once the lockdown restrictions ended.

During this period, there was robust demand for cotton yarn which no one had anticipated.” Meanwhile, a SIMA member and Tirunelveli-based mill owner Maninarayan Velayutham wonders, “What the future will be like going forward, in the backdrop of sharp spurt in cotton yarn rates.”

SIMA Chairman, Ashwin Chandran, however, believes that there’s no need to panic in case of procuring cotton yarn at the moment, as rise in yarn output in the next 2-3 months is expected to stabilise the prices.

He adds that units of several cotton textiles have resumed operations along with various spinning mills that were shuttered during lockdown. This will ensure uninterrupted availability of cotton yarn, cooling off heated prices for a while.

Mumbai-based garment and yarn company owner PH Udani expects the supply-demand imbalance to smooth out with improvement in production of cotton yarn in the coming months. This will eventually help put a brake on the northward rally of yarn prices, for a while.

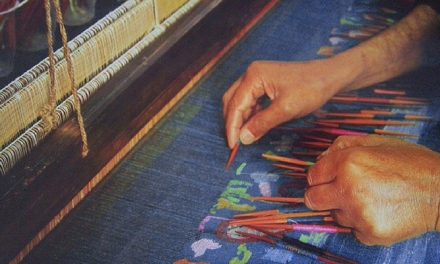

Even the handloom sector has been at the receiving end of the challenges arising from exorbitantly high cotton yarn prices. Textiles companies based in Maharashtra’s Ichalkaranji have suffered severe pressure on their margins. Manufacturers reveal that cotton yarn and synthetic yarn prices have surged 50-60 per cent in the last 3-4 months. It is to be noted that the current yarn rates are even 20-30 per cent higher than the rates in pre-covid times. However, its product rates have risen by just 20-30 per cent.

Having said so, mill owners along with retail store owners across the major markets agree that demand for casuals and fabrics have improved in rural India. However, they observe that raising the prices of the end-products has been difficult due to cut-throat competition. Input costs continue to be on the higher side due to shortage of labour and mill-workers.

NITMA President also agrees that after the removal / ease in lockdown restrictions, a major shift in demand has been witnessed towards villages and districts. He adds that nearly 70 per cent demand for

fabric is directed towards rural India.

ICRA reports that fabric production is also likely to revert to growth in FY2022, with improved demand from the downstream segments. “Within fabrics, cotton knitted fabrics and blended knitted fabrics are likely to perform better, given the shift being witnessed in consumer usage and preferences, in favour of casual/active/lounge wear.” Having said so, it adds that the garment sector may continue to suffer from suppressed margins, even as spinning mills’ margins rebound to pre-covid levels.

Although, in FY 2021-22, fabric and domestic apparel industry revenues are seen growing at the rate 30- 35 per cent and 35-40 per cent respectively, revenues in both the categories had declined severely in the current financial year.

Supported by export demand, even as demand from domestic downstream segments may recover at a slower pace, yarn realisations and contribution margins are expected to remain at comfortable levels in FY2022…, ICRA’s report said in its key metrics section.