In the 2ndhalf of March 2022, the ITMF conducted the 13th ITMF Corona-Survey amongst more than 220 companies around the world in all segments along the textile value chain. For the sixth time since May 2021, companies were asked the same set of questions about their 1) business situation, 2) business expectation, 3) order intake, 4) order backlog, and 5) capacity utilization rate. In addition, they were asked about their main concerns and whether and to what extent they can pass on recent costs increases.

In the 2ndhalf of March 2022, the ITMF conducted the 13th ITMF Corona-Survey amongst more than 220 companies around the world in all segments along the textile value chain. For the sixth time since May 2021, companies were asked the same set of questions about their 1) business situation, 2) business expectation, 3) order intake, 4) order backlog, and 5) capacity utilization rate. In addition, they were asked about their main concerns and whether and to what extent they can pass on recent costs increases.

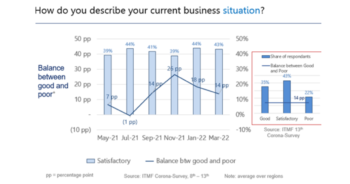

On average across all regions and all segments, the business situation in March 2022 (see Graph 1) remains in positive territory with +14 percentage points (pp). Nevertheless, this is well below the +26pp in November 2021 and the +18pp in January 2022. That a relative high number of companies (43 percent) judge their situation as satisfactory shows that demand remains strong despite the many challenges companies are facing on the supply side like delayed deliveries and higher production costs.

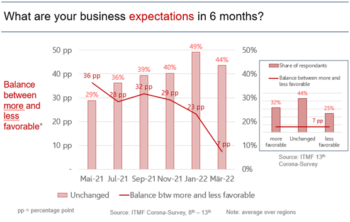

When it comes to the business expectations in six months’ time, the global textile value chain remains optimistic but stands on a much weaker foundation (see Graph 2). Since September 2021 the balance between more favorable and less favorable business expectations has fallen from +32pp to +7pp. This is a clear indication that the textile value chain has passed the tip of a strong business cycle in the 4th quarter of 2021. Whether we will see a broader albeit slower economic growth in the future will depend very much on whether disrupted global supply chains will be rebalanced and how the Russian war in Ukraine will develop in the coming months.

When it comes to the business expectations in six months’ time, the global textile value chain remains optimistic but stands on a much weaker foundation (see Graph 2). Since September 2021 the balance between more favorable and less favorable business expectations has fallen from +32pp to +7pp. This is a clear indication that the textile value chain has passed the tip of a strong business cycle in the 4th quarter of 2021. Whether we will see a broader albeit slower economic growth in the future will depend very much on whether disrupted global supply chains will be rebalanced and how the Russian war in Ukraine will develop in the coming months.

A look at the different regions reveals that the business situation is in positive territory in all regions except for East Asia and Africa where the balance between good and bad business situation is negative. The expectations on the other hand vary strongly. In North, South America and Africa companies anticipate a more favorable business, while in all other regions the balance between more and less favorable is negative.

As for the different segments the downstream segments – weavers/knitters, finishers/printers, and garment and home textile producers – are generally struggling more than the upstream segments – fiber producers, spinners, and textile machinery producers. This is especially true when it comes to passing on higher costs.

The order intake has fallen from a high level of +38pp in November 2021 to +12ppin March 2022. This reflects the weaker business situation. Likewise, also order intake expectations deteriorated in March 2022from +34pp in January to +22ppin March 2022.

Since July2021 order backlog rose from 2.3 to3.1 months. The expectations for order backlog remain unchanged at 2.9 months. The capacity utilization rate stays at around 80 percent. The expectations are unchanged given the persistent supply chain bottlenecks.

Higher costs for raw materials, energy, and transportation are the main concerns for companies. Weaker demand is another worry though not (yet) a dominant one. On average across the supply chain companies can only pass on 40% of the additional costs.