India has decided against joining the Chinabacked mega Regional Comprehensive Economic Partnership (RCEP) Agreement. That should set at rest fears that the Indian market would have been swamped by cheap Chinese imports including textiles and garments. It is to be noted that China’s share in India’s textiles and clothing (T and C) exports is more than 70 per cent making it the dominant player amongst the 16-member RCEP.

Amongst the RCEP countries, India’s more than 50 per cent exports are destined to China. By not making the deal, has New Delhi taken the right decision? Trade experts, however, feel that New Delhi could have made out a “negative” list of items disallowing any RCEP members to import them into India by slapping heavy tariffs. This has been the norm adopted by India while signing Free Trade Agreements (FTAs) with several countries in the past.

With the proposed Broad-based Trade and Investment Agreement (BITA) with the 28- member European Union getting stalled due to serious differences between the two, it is time for India to shift the focus on signing FTAs with RCEP members.

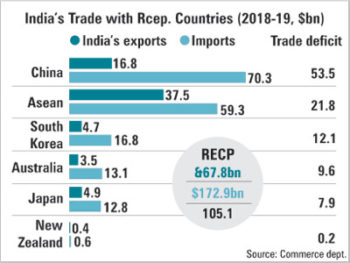

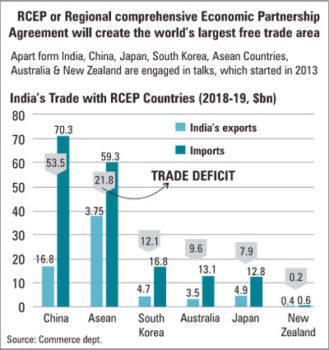

Our stakes are high in the RCEP bloc where we must get duty free access for value-added products like readymade garments and madeups. New Delhi’s offer should consist of manmade fibres (MMFs) and speciality fabrics which are readily available in the RCEP countries. Two-way trade between India and RCEP stood at $340.7 bn in 2018-19 with exports amounting to $67.8 bn and imports to $172.9 bn, resulting in a high trade deficit of $105.1 bn for India, as per the Commerce Department’s data.

Our stakes are high in the RCEP bloc where we must get duty free access for value-added products like readymade garments and madeups. New Delhi’s offer should consist of manmade fibres (MMFs) and speciality fabrics which are readily available in the RCEP countries. Two-way trade between India and RCEP stood at $340.7 bn in 2018-19 with exports amounting to $67.8 bn and imports to $172.9 bn, resulting in a high trade deficit of $105.1 bn for India, as per the Commerce Department’s data.

To ensure duty free access, rules of origin (ROO) must be invoked as in the case of Sri Lanka and Bangladesh. For this, we must seek bilateral cumulation, instead of regional cumulation, as recommended by CITI. Under this, a two-way formula should be followed where the raw material used in production of an export item is manufactured in the exporting country or imported from the destination markets of RCEP if the raw material is non-originating. For instance if Vietnam wants to export garments to India by RCEP preference, then its raw material fabric and other accessories (used to produce garments) should either be produced in Vietnam or imported from India and converted into garments and re-shipped to India from Vietnam.

Apart from the threat of cheap imports from China, another major factor that weighed with the government to not initial that pact with RCEP is the revenue consideration. The Revenue Department argues that concessions could easily top rs. 30,600 cr a year once they kick in and will nearly double to rs. 60,000 cr after the agreement is fully in force. The revenue forgone from the trade agreement with ASEAN more than doubled to nearly rs. 26,000 cr in 2018-19 from the preceding year.

It is a notional loss, though the experience shows that under the existing FTAs imports have grown faster than exports, with little gains accruing to India on the services front. Low import duty in some of RCEP countries will have

It is a notional loss, though the experience shows that under the existing FTAs imports have grown faster than exports, with little gains accruing to India on the services front. Low import duty in some of RCEP countries will have

a great impact on our manufacturing sector. Referring to several concerns raised on a number of issues by India in respect of the India-Asian Comprehensive Economic Co-operation Agreement (CECA) that has been in vogue for nearly a decade, New Delhi wants to ensure that they do not recur in RCEP. More importantly Commerce and Industry Minister Piyush Goyal firmly believes that non-tariff barriers (NTBs) are preventing India’s exports from entering several markets. In Japan and South Korea for instance the local industry has raised barriers to of India’s steel exports.

Having opted out of RCEP, New Delhi is possibly considering signing separate agreements with some of the countries that will be a part of the bloc such as Australia and New Zealand and those with which negotiations have not made substantial progress such as the Eu. Further negotiations on the long-pending BITA may have to be put off till there is greater clarity on Brexit for which an extension has been provided. The aim is to seek easier access by way of lower import duties on products such as textiles and garments and market access for several other Indian products Brexit is also expected to pave the way for a trade pact with the UK. India is in a position to sign a CECA with Australia, if it is willing to allow easier visa access to Indian professionals.

India is also exploring an agreement with the US in what is described as a major strategic shift in its policy. For long, New Delhi has shot down proposals for an FTA with the US and has denied that there is any move in this regard. Commerce and Industry Minister has however said that there is no rush to sign any trade pact and will sign only those which safeguard its interests. Needless to say the US again is an important destination for T and C exports. India is the third largest supplier of textiles and apparel to the US. In the absence of an FTA these exports could at best keep the rate at 5.5 percent Compounded Aggregate Growth Rate (CAGR) over the next five years as in the previous five years.

However after signing of an FTA, T and C exports will get duty advantage in the range of 10-32 percent in various product categories. This will give a major boost to exports as China’s manufacturing cost has been rising. A study by FICCI and Wazir Advisers reveal that India’s FTA with the US will majorly improve its share in US’s apparel imports, from a value of 5-8 per cent, it could increase as high as 20 per cent by 2020. India’s share in US’s imports of textiles will also increase substantially in segments of MMF yarn and fabrics. As reported in these columns the current global apparel market is worth $1.7 tr and it constitutes two percent of GDP. EU-28, US and China are the largest apparel markets with a combined share of about 54 per cent. The global apparel market size is expected to touch $2.6 tr in 2025 by a projected rate of 4 per cent. The major growth drivers of the market will be developing economics, mainly China and India, both growing in double digits. China will become the biggest apparel market adding more than $378 bn in market size by 2025.

However after signing of an FTA, T and C exports will get duty advantage in the range of 10-32 percent in various product categories. This will give a major boost to exports as China’s manufacturing cost has been rising. A study by FICCI and Wazir Advisers reveal that India’s FTA with the US will majorly improve its share in US’s apparel imports, from a value of 5-8 per cent, it could increase as high as 20 per cent by 2020. India’s share in US’s imports of textiles will also increase substantially in segments of MMF yarn and fabrics. As reported in these columns the current global apparel market is worth $1.7 tr and it constitutes two percent of GDP. EU-28, US and China are the largest apparel markets with a combined share of about 54 per cent. The global apparel market size is expected to touch $2.6 tr in 2025 by a projected rate of 4 per cent. The major growth drivers of the market will be developing economics, mainly China and India, both growing in double digits. China will become the biggest apparel market adding more than $378 bn in market size by 2025.

These two countries, with a large and growing domestic demand, coupled with spending power of people, will lead to a combined addition of around $500 bn in the global apparel market size by 2025. The combined apparel market size of India and China that is, $795 bn, is expected to exceed the combined size of the EU and the US that is $775 bn by 2025. China believes that India will gain by signing the RCEP agreement. “If it is signed and put into implementation, it is conducive for Indian goods’ entry into China and other participating countries. In the same vein, it will also help Chinese goods to enter the markets of India and other participating countries,” said Geng Shuang Chinese Foreign Ministry spokesman. For China, RCEP is seen to crucial as it is an answer to US President Donald Trump’s threat of sanctions against Chinese goods. For India, the bottom line is to protect the interests of its farmers, small businesses and domestic industry. This however has not materialized in the earlier trade pacts.

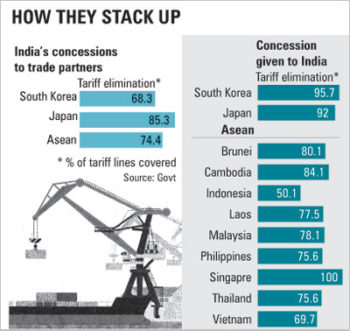

India now proposes to review the Comprehensive Economic Partnership Agreement (CEPA) with ASEAN after New Delhi has been able to convince the 10-member trade bloc. Indonesia has offered to lower or eliminate duties on close to 95 per cent of items, just around half the products will see tariff elimination. In contrast, New Delhi has agreed to shift 74 per cent of the goods to zero duty as part of the deal.